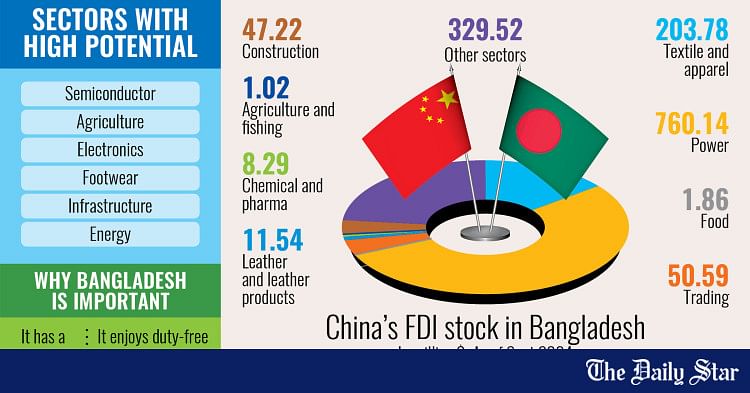

Foreign direct investment (FDI) from China in Bangladesh has risen to $2.67 billion as of September 2024, according to official data, cementing China’s position as the country’s second-largest investor.

This FDI stock includes $1.41 billion from mainland China and $1.26 billion from Hong Kong, according to the Bangladesh Bank (BB), reflecting a broader effort by Chinese firms to diversify amid the US-China trade war.

Bangladesh, with its low-cost labour and expanding industrial base, has emerged as an attractive destination for Chinese companies seeking alternatives to traditional manufacturing hubs.

The textile sector, a pillar of Bangladesh’s export economy, has received the largest share of Chinese FDI, totalling $760.14 million. The telecommunications sector has also drawn substantial Chinese investment, with $322.45 million funnelled into expanding 4G and 5G networks.

Beyond these core industries, Chinese capital is flowing into agriculture, energy and pharmaceuticals, strengthening Bangladesh’s infrastructure and supply chains.

The trading sector alone has attracted $203.78 million, according to BB data, modernising logistics and enhancing the country’s global competitiveness.

Experts say these investments could increase further if Bangladesh creates a more business-friendly environment, making it a prime beneficiary of shifting global trade dynamics.

“By developing infrastructure and fostering a business-friendly environment, Bangladesh can attract more Chinese investment, especially in sectors like electronics, textiles and agriculture,” said Al Mamun Mridha, secretary general of the Bangladesh China Chamber of Commerce and Industry (BCCCI).

Mridha said the trade war has opened up several opportunities for Bangladesh as Chinese companies look to relocate, especially in the semiconductor industry.

He also highlighted emerging opportunities in agriculture as shifting trade relations increased demand for alternative sources.

Bangladesh’s garments and footwear sectors, he said, have great potential, citing Vietnam’s rapid progress as an example. Tapping into the sneaker and footwear market could boost exports.

The BCCCI secretary general said other promising sectors include electronics, the blue economy and fisheries.

Advanced technology in fish exports, he added, could enhance Bangladesh’s global competitiveness.

Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD), said that while China is investing heavily in Vietnam and Cambodia, Bangladesh has yet to attract the same level of commitment.

However, he said the ongoing trade war and evolving global economic conditions have made Bangladesh a viable option for Chinese investors, provided the country seizes the opportunity.

Although Chinese investments are present, Bangladesh has not fully capitalised on its potential. “For instance, we built the Karnaphuli Tunnel, but the special economic zone for China in Chattogram’s Anwara is yet to be fully developed,” Rahman pointed out.

If China expands its investments, its companies could manufacture in Bangladesh and export not only to China but also to other markets, including the US, minimising the impact of high tariffs, he added.

The US government has imposed an additional 10 percent tariff on Chinese goods recently, limiting market access of “Made in China” products to the American market.

Rahman said that Bangladesh’s duty-free access to Europe, the UK and Canada presents a significant advantage in this regard.

Chinese firms could use the country as a gateway to these markets, he said, but attracting greater investment requires an improved business climate and the removal of regulatory barriers.

Riad Mahmud, managing director of National Polymer Group and a non-leather shoe exporter, said that while his company has not yet received investment proposals from China, US buyers have begun inquiring about factory capacity and compliance, often with the assistance of Chinese firms.

Since Bangladesh does not have a dedicated buying house for synthetic shoes, Mahmud said, the industry, less mature than those in China and Vietnam, depends on Chinese companies to access the US market.

He added that both Chinese firms and US buyers increasingly view Bangladesh as a viable alternative to China, leading to a rise in buying inquiries and fresh opportunities for the country.

Meanwhile, the construction of the Chinese Economic and Industrial Zone (CEIZ) in Chattogram has yet to begin, though the Bangladesh Economic Zones Authority (Beza) initiated the project nine years ago to attract foreign investment.

However, there is a possibility of discussions to expedite its implementation during the tenure of the interim government. Besides, Beza is eager to secure approval for the CEIZ’s detailed project plan from the Executive Committee of the National Economic Council (ECNEC), according to sources.

Beza has reported a steady rise in Chinese investment in export processing zones. Between July 2024 and March 2025, 29 investment agreements have been finalised, 19 of which involve Chinese companies.

This growing interest underscores Bangladesh’s potential to attract further foreign investment and drive economic growth.

For all latest news, follow The Daily Star’s Google News channel.

For all latest news, follow The Daily Star’s Google News channel.