Bangladesh’s economy exhibited a gradual recovery in the second quarter of fiscal year 2024-25, but it faces substantial hurdles, including inflationary pressures, a shortfall in revenue collection, slow public spending, diminished job opportunities and a sluggish investment climate.

In addition, there is a need to rebuild public confidence in the banking system, the Metropolitan Chamber of Commerce and Industry (MCCI) said in its quarterly review of Bangladesh’s economic situation for the October-December quarter of FY25.

“Restoring law and order is indeed a critical priority to create a stable environment for economic activities,” the MCCI said in the review released yesterday.

The leading chamber said key economic indicators such as exports and remittances demonstrated positive trends.

“The economy has been recovering gradually from political instability that began in the first week of July 2024.

“The slide experienced by the foreign exchange reserves was halted, and the exchange rate of Bangladeshi taka against major currencies stabilised, although some volatility in the reserve position continues to persist.

“Improved trade and current account balance, and the overall balance of payments situation, allowed for some de-restriction of import activities,” the trade body added.

However, high inflation and slow revenue collection remain major concerns.

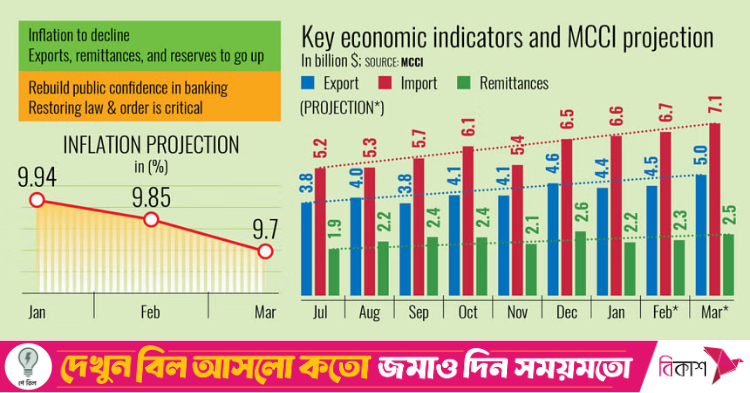

Bangladesh has been grappling with over 9 percent inflation since March of 2023. In January, the consumer price index, a measure of changes in the price of a basket of goods and services, stood at 9.94 percent.

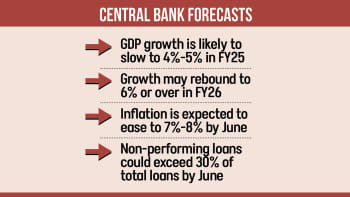

Despite improvements in foreign trade and remittances, inflation remains a critical concern, the MCCI said, adding that the country’s central bank has maintained a tight monetary policy stance to curb inflation and stabilise the exchange rate.

The chamber projects that inflation, which eased for the second consecutive month in January, may decline to 9.85 percent this month and 9.7 percent in March.

It said the Bangladesh Bank’s efforts, along with the positive trends in exports and remittances, are expected to support broader economic recovery in the coming months.

The chamber said Bangladesh’s exports rose 12.8 percent year-on-year to $24.54 billion, primarily driven by the ready-made garments sector.

It said buoyancy in exports might continue in the third quarter with shipments gradually rising. Exporters may ship products worth $4.9 billion in March, up from a projected $4.5 billion in February, the chamber added.

Similarly, Bangladeshi migrants working and living abroad are expected to send a good amount of remittance next month ahead of Eid-ul-Fitr, the biggest religious festival for Muslims and a time when the overall economy gets a big boost because of a shopping bonanza to celebrate the festival.

Remittance inflows, which saw a 27.56 percent uptick in the first half of the current fiscal year, are likely to be around $2.5 billion next month. Better remittance inflow has been attributed to improved banking governance and foreign exchange stability, boosting expatriate confidence.

Consequently, Bangladesh’s foreign exchange reserves, which have been strained for nearly three years, are expected to go up.

The MCCI said gross forex reserves might cross $26 billion in March.

The chamber said the country’s trade deficit narrowed and the pressure on the balance of payments, which shows a country’s transactions with the rest of the world, improved in the first half of FY25.

The trade deficit narrowed year-on-year to $9.76 billion in the July-December period of this fiscal year from $10.88 billion.

However, the industry and services sectors showed a mixed performance.

The MCCI said the industrial sector registered lower growth in the first quarter of FY25 compared to the previous quarter as it suffered due to a sharp slowdown in manufacturing growth. The services sector also witnessed weaker growth.

Foreign investment also fell amid economic uncertainties, infrastructure constraints and regulatory inconsistencies.

The MCCI said Bangladesh’s economy is gradually overcoming the difficulties brought on by the present political uncertainty and conflicting world scenario.

“Therefore, the performances of the selected economic indicators are mixed.”

For all latest news, follow The Daily Star’s Google News channel.

For all latest news, follow The Daily Star’s Google News channel.