In its monetary policy statement, BB says growth outlook for 2nd half of FY25 doesn’t appear optimistic

The Bangladesh economy is bracing for substantial hurdles in the second half of the 2025 fiscal year, with growth projected to decelerate amid inflationary pressures, financial strain and external headwinds.

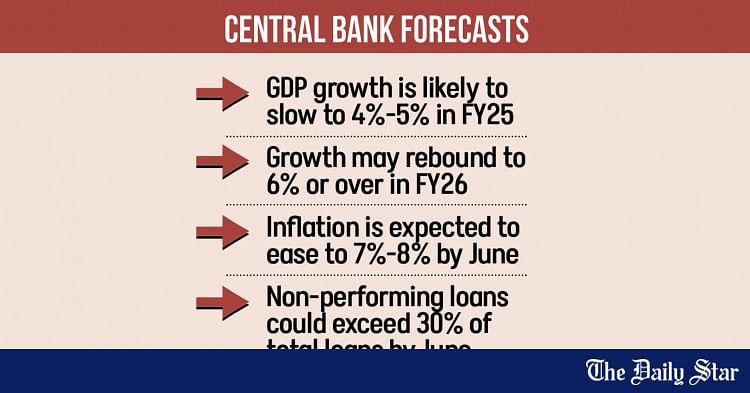

GDP growth is expected to remain in the 4-5 percent range in FY25, reflecting continued output losses from floods, labour unrest, and gas supply shortages that have slowed industrial production, Bangladesh Bank said yesterday in a monetary policy statement for the January-June period.

“The growth outlook for the second half of FY25 for Bangladesh does not appear optimistic due to the existing challenges,” the central bank said.

Bangladesh’s struggles underscore the uneven recovery across South Asia. Bangladesh faces a tougher road to recovery due to inflation, domestic disruptions and external shocks. The next several months will be pivotal as the country works to balance fiscal and monetary reforms, restore confidence in its financial system, and chart a path towards long-term stability and growth.

The trend of elevated inflation predates the interim government, as the post-pandemic economic recovery was sluggish during Sheikh Hasina’s tenure. Real GDP growth slowed to 4.22 percent in FY24, amid sustained high inflation driven by the Russia-Ukraine war, global uncertainty, and weak economic performance by key trading partners and remittance source countries.

Then economic activity faced additional setbacks in the summer of 2024 when a student-led mass uprising, followed by a change in government, created uncertainty among consumers and investors. This uncertainty was reflected in a sharp decline in real GDP growth to just 1.81 percent in the first quarter of FY25, down from 3.91 percent in the final quarter of FY24.

Now, as consumer prices eased for the second month in January, the central bank left the key policy rate at 10 percent and aims to contain inflation to 7-8 percent by June.

“Bangladesh Bank has adopted a pragmatic approach to lowering inflation by approximately 200 to 300 basis points by the fiscal year’s end. This objective is challenging but achievable, particularly if supply-side inflation pressures are mitigated,” said Zahid Hussain, former lead economist of the World Bank’s Dhaka office.

“There are signs that inflation expectations are easing, as evidenced by long-term interest rates dipping below short-term rates. It is certainly refreshing to see an official document that broadly reflects the realities on the ground.”

And, as the central bank expects political situation to improve, growth is expected to bounce back to 6 percent or above in the 2026 fiscal year.

Bangladesh’s economic pain is mirrored in the broader global outlook, as emerging markets and developing economies are also expected to experience a slowdown. Growth in those economies is projected to decline from 4.4 percent in 2023 to 4.2 percent in 2024 and 2025. This slowdown is tied to ongoing weaknesses in China’s real estate sector, low consumer confidence, and the fading of pandemic-era pent-up demand in India. In South Asia, only India is predicted to sustain robust GDP growth, exceeding 6 percent by 2025.

Despite challenges, the Bangladesh economy is expected to find some relief in higher remittance inflows, strong growth in garment exports, and increased private demand during two upcoming religious festivals, according to the central bank. These factors are anticipated to cushion the slowdown and provide a foundation for recovery.

BANKS FACE RISING BAD LOANS

One of the major shocks to the economy originates from the financial sector, where several banks in Bangladesh are facing a severe liquidity crisis. This has been exacerbated by rising non-performing loans (NPLs), sluggish deposit growth, and weak loan recovery. To stabilise their liquidity positions, the central bank has permitted struggling banks to access the interbank market under guarantees provided by the central bank.

The central bank has also provided temporary liquidity support to some banks, while simultaneously issuing BB bills to absorb excess liquidity and prevent long-term financial imbalances.

The surge in NPLs is raising serious concerns for the banking industry, with a projection suggesting the NPL rate could exceed 30 percent of total outstanding loans.

“Systemic weaknesses, regulatory gaps, and exploitative practices such as money laundering and illicit capital flight have been identified as contributing factors,” the central bank said.

In response, BB has introduced new guidelines aligned with the best international practices for loan classification, provisioning and recovery.

“Strengthening regulatory oversight and effectively implementing these reforms will be crucial for restoring stability, resilience, and public trust in the country’s banking sector,” the central bank said.

For all latest news, follow The Daily Star’s Google News channel.

For all latest news, follow The Daily Star’s Google News channel.