The homegrown investment bank came up with this estimation by comparing economic output in the region against electricity consumption, according to its “Macro Economic Outlook 2025” report

Infograph: TBS

“>

Infograph: TBS

Summary:

- Bangladesh’s GDP for FY 2023-24 estimated at $300 billion.

- Electricity consumption suggests overstated GDP by the previous government.

- Report doubts economic outlier status without strong service or production sectors.

- Recalibrated GDP could raise debt-to-GDP ratio from 36% to 55%.

The actual size of Bangladesh’s GDP for the fiscal 2023-24 has been estimated at around $300 billion by City Bank Capital Resources, significantly lower than the previous government’s overstated figure of $459 billion.

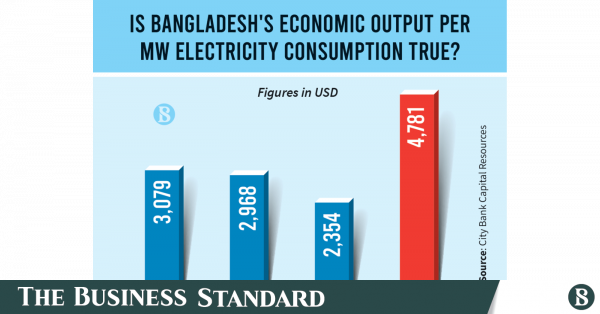

The homegrown investment bank came up with this estimation by comparing economic output in the region against electricity consumption, according to its “Macro Economic Outlook 2025” report.

Citing the Bangladesh Power Development Board, City analysts said the country consumed only 96 million megawatts of electricity in the last fiscal year ending in June, which is much lower than the regional benchmarks.

They doubted the GDP figure, questioning how Bangladesh’s economy could have an outlier edge for an astonishing 50-60% higher economic output than India, Pakistan, or China per unit of electricity consumption.

“Bangladesh’s GDP figures need recalibration,” the report stated.

City Bank Capital forecasts that the actual export figure for FY24 will be $44.5 billion – $10 billion less than the previous government’s overstated estimate – and could soar to around $50 billion this fiscal year.

There has been suspicion that the ousted Sheikh Hasina government overstated economic figures, including exports and GDP, according to Md Abdullah Al Faisal, City’s first assistant vice president for corporate advisory and research.

“We found no reason to give Bangladesh the benefit of the doubt, as neither its service sector nor high-value production contribute exceptionally to its GDP,” he said.

He added that a country’s service sector and high-value production typically help generate a comparatively higher economic output, which is not the case for Bangladesh.

Citing slower growth projections for this fiscal year – 4% by the World Bank and 5.1% by the Asian Development Bank – City expressed concern that Bangladesh could fall into a middle-income trap due to structural economic challenges.

The report highlights the burden of legacy government debt and contractionary fiscal and monetary policies, which have further constrained economic growth.

Underfunded social safety nets and weak institutional frameworks also worsened vulnerabilities. It advises that pushing for least developed country graduation at this stage could limit access to critical concessional financing and trade preferences, recommending that Bangladesh reconsider this path until it achieves more stable and sustainable growth.

City Bank Capital noted that the reported 36.43% total debt-to-GDP ratio could rise to 55% with the recalibration of GDP figures, as the external debt level could surge from 15% to 28%.

“The inflated costs of projects undertaken by the previous government have raised debt levels, and servicing this debt will become increasingly challenging in the coming years, especially given the limited returns from these investments,” the report added. “Prudent fiscal management and efficient resource utilisation are crucial to avoid further financial distress.”

However, the stabilisation of foreign currency reserves and the taka signal emerging signs of resilience, offering a potential turning point for the economy.

City Bank Capital forecasts that the actual export figure for FY24 will be $44.5 billion – $10 billion less than the previous government’s overstated estimate – and could soar to around $50 billion this fiscal year.

A 9.04% increase in industrial raw material imports in the first four months of the ongoing fiscal year signals a recovery in production, particularly in export sectors. However, a drop in capital machinery imports reflects a weaker investment appetite, it added.

City analysts also expressed concerns that the central bank’s stance on proper reporting of banks’ distressed assets could push the industry’s non-performing loan ratio to over 30% after March.

“Remittances could reach $28 billion this fiscal year, providing critical support to Bangladesh’s fragile economy,” they projected, noting an over 26% growth in the July-November period.

The report highlighted the poor net foreign direct investment inflow – only 0.3% of GDP, the lowest among regional peers – persistent high inflation, and high borrowing rates as major challenges.

After a 42% appreciation in recent years, the official dollar price could rise to Tk127 in 2025, from Tk120 now, while the kerb market rate has already hit Tk126 per dollar, according to City.

“Bangladesh is grappling with both a current account deficit and a budget deficit, commonly referred to as a twin deficit,” the report concluded.