Highlights:

- Government sets Tk5.64 lakh crore revenue target for FY26

- Economists call the 27.98% growth target unrealistic

- Average revenue growth under 14% over past decade

- Inflation, liquidity crisis, slow budget hinder revenue growth

- Proposed measures: expand tax net, standardize VAT, strengthen NBR

- Experts urge curbing evasion, boosting NBR, aligning with GDP

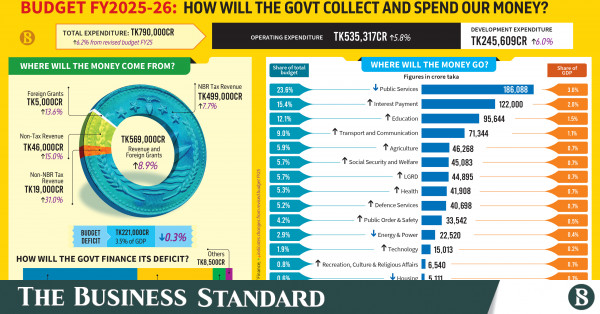

The government has unveiled an ambitious revenue collection target of Tk5.64 lakh crore for the upcoming fiscal year 2025-26, with Tk4.99 lakh crore earmarked from the tax sector. This comes despite a significant shortfall in the current fiscal year, where tax revenue for the first 10 months stood at a mere Tk2.90 lakh, reflecting a less than 4% growth.

Economists are largely viewing the increased target for FY26 as “unrealistic,” especially given projections from various research organisations that the current fiscal year could end with a deficit of at least Tk1 lakh crore.

Speaking at the recent “State of the Economy: Third Quarter” event, Fahmida Khatun, executive director of the Centre for Policy Dialogue (CPD), said considering the current revenue collection trend, the shortfall for the current year is indeed expected to be Tk1.05 lakh crore.

This implies a growth target of 27.98% for the next fiscal year’s revenue compared to the current year’s estimated Tk3.6 lakh crore. Such a target appears particularly challenging given that Bangladesh’s revenue growth has averaged less than 14% over the past decade, according to economists.

This budget has been presented at a time when macroeconomy is just beginning to recover from a significant downturn, even though the country still grapples with high inflation, a liquidity crisis in banks, and slow budget implementation.

Fahmida Khatun, executive director, CPD

Fahmida emphasised that any target should be set considering economic realities and past trends, which she believes has not been the case for the revenue target. “This budget has been presented at a time when the macroeconomy is just beginning to recover from a significant downturn, even though the country still grapples with high inflation, a liquidity crisis in banks, and slow budget implementation.”

Despite these concerns, Finance Adviser Salehuddin Ahmed, in his budget speech yesterday, outlined measures to boost revenue collection, including rationalising tax exemptions, strengthening the National Board of Revenue (NBR) by increasing its workforce, expanding the tax net, and standardising VAT rates across various goods and services where possible.

Economists also believe that the government’s non-tax revenue target for the next fiscal year is unattainable, despite the adviser setting a lower target for non-tax revenue and non-NBR taxes compared to the current fiscal year.

Abdul Majid, a former secretary of the Internal Resources Division, said achieving the revenue target for the upcoming fiscal year would be difficult. However, he deemed the target setting itself as “logical,” arguing that revenue collection is far too low compared to the size of the economy.

He stressed the need to abandon a “concessionary mindset,” curb tax evasion, and ensure that businesses operating on the country’s infrastructure pay their taxes. He also called for an increase in NBR’s capacity.

Majid highlighted a positive aspect of the current budget: its focus on increasing income by reducing expenditure. He believes there is ample opportunity to boost revenue, which must be fully utilised.

Average revenue collection growth stands at 10-13%

Statistics indicate that over the last decade, Bangladesh’s revenue collection has grown by an average of 10-13%. However, budget projections often estimate growth at 30-40%. This significant disparity between government expectations and actual receipts leads economists to believe that there is a considerable gap between aspiration and reality.

Fariduddin, a former NBR member, pointed out that “the tendency for tax evasion is very high in our country. Revenue collection is significantly lower compared to the size and growth rate of our GDP. Bangladesh’s tax-to-GDP ratio should be at least 17%. Achieving this would make the revenue target attainable.